Do you ever feel like your money is slipping through your fingers? You work hard, but somehow, the end of the month always arrives with a bank account that feels a little too empty. If this sounds familiar, you’re not alone. Millions of people struggle to manage their finances effectively. But what if there was a simple tool that could change everything?

Enter the home budget template, your secret weapon in the fight for financial freedom. It’s more than just a spreadsheet; it’s a roadmap to taking control of your money and achieving your financial goals. Whether it’s saving for a dream vacation, paying off debt, or securing a comfortable retirement, a budget template empowers you to make informed spending decisions and build a secure financial future.

In this blog post, we’ll delve into the power of home budget templates. We’ll explore why they’re essential for financial well-being, and guide you through crafting a sustainable budget template that fits your unique needs.

Why You Need a Home Budget Template

Managing personal finances can often feel overwhelming, especially when trying to juggle multiple sources of income and a myriad of expenses. This is where a home budget template becomes an invaluable tool. Not only does it simplify the process of tracking your money, but it also empowers you to make informed financial decisions and achieve your savings goals. Let’s explore how a budget template can transform your financial life.

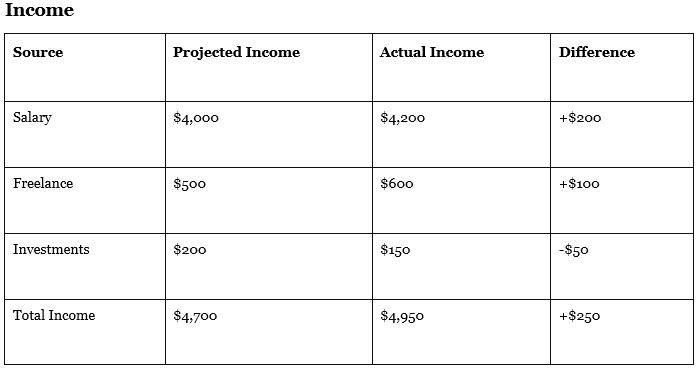

Track Income from Various Sources

In today’s diverse economy, many of us receive income from multiple avenues—salaries, freelance work, investments, side gigs, and more. A holistic view ensures you know exactly how much money is coming in, helping you to plan effectively and avoid the pitfalls of underestimating your earnings.

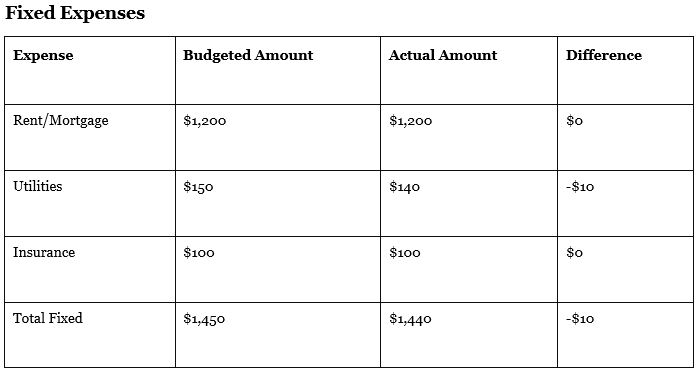

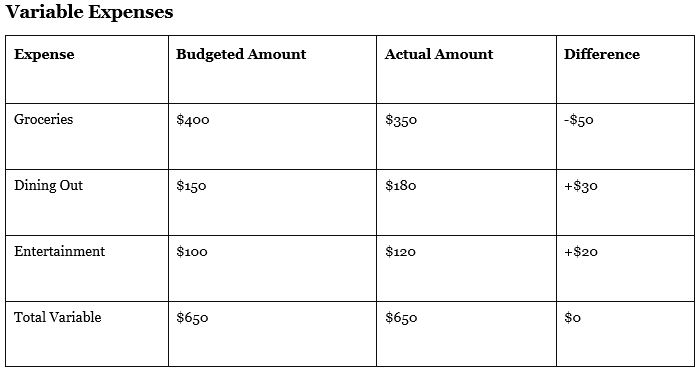

Categorize Expenses: Fixed and Variable

Fixed expenses—such as rent, mortgage payments, utilities, and insurance—are those that remain relatively constant each month. Variable expenses, on the other hand, fluctuate and include items like groceries, dining out, entertainment, and travel.

By categorizing your expenses, you gain a clearer understanding of where your money is going.

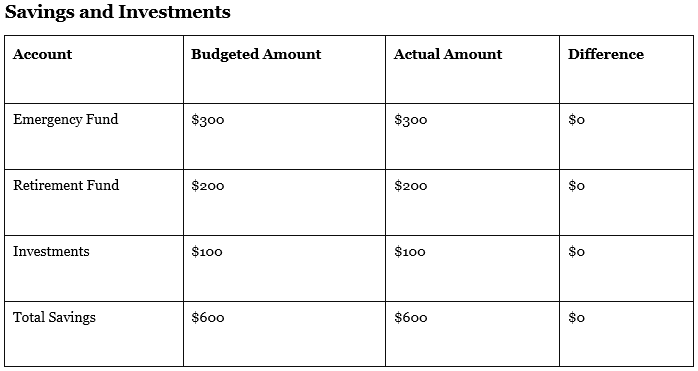

Allocate Funds Towards Savings Goals

Whether you’re aiming to build an emergency fund, save for a down payment on a house, or plan for a vacation, a budget template helps you allocate funds toward these objectives systematically.

Guide to Sustainable Budgeting

Conquering your finances is a marathon, not a sprint. That’s why your budget needs to be as unique and adaptable as you are. Forget one-size-fits-all plans! The key to a sustainable budget is customization.

Here’s the blueprint for your personalized budget template:

● List all your income sources, from your regular paycheck to side hustles or passive income streams. Be sure to include the average monthly amount for each source.

● Divide your expenses into two main camps: Fixed Expenses are those that stay the same each month (rent, utilities, loan payments). Variable Expenses can fluctuate (groceries, entertainment, dining out). This breakdown helps you identify areas to potentially cut back on variable spending if needed.

● Allocate specific amounts towards these goals each month. Seeing your progress is a powerful motivator that keeps you focused.

Creating a home budget template using “Wealth Rhythm”

It involves aligning your financial planning with principles of rhythm and consistency. Here’s a step-by-step guide to creating a home budget template inspired by the Wealth Rhythm approach:

Step 1: Define Your Wealth Rhythm Goals

- Set Financial Goals: Identify your short-term and long-term financial goals. These could include saving for a vacation, paying off debt, or building an emergency fund.

- Prioritize: Rank these goals based on importance and urgency.

Step 2: Gather Financial Information

- Income: List all sources of income, including salary, freelance work, investments, etc.

- Expenses: Categorize your expenses into fixed (rent, utilities, insurance) and variable (groceries, entertainment, dining out).

Step 3: Create a Budget Template

Using a spreadsheet or a budgeting app, create a template with the following sections:

- Income Section:

● List each income source.

● Include columns for projected and actual income.

- Expense Section:

● Fixed Expenses: List monthly fixed expenses.

● Variable Expenses: List anticipated variable expenses.

● Include columns for budgeted amount, actual amount, and difference.

- Savings and Investments:

● Allocate a portion of your income to savings and investments.

● Track contributions to savings accounts, retirement funds, and investment portfolios.

Step 4: Incorporate Wealth Rhythm Principles

- Regular Review: Set a schedule for regular budget reviews (weekly, bi-weekly, or monthly) to ensure consistency and rhythm.

- Adjust and Adapt: Make adjustments based on your financial rhythm. If your income or expenses fluctuate, adapt your budget accordingly.

- Automate Savings: Use automatic transfers to ensure consistent savings contributions.

Step 5: Monitor and Analyze

- Track Spending: Regularly update your actual expenses to see where your money is going.

- Analyze Patterns: Look for spending patterns and identify areas where you can cut back or need to allocate more funds.

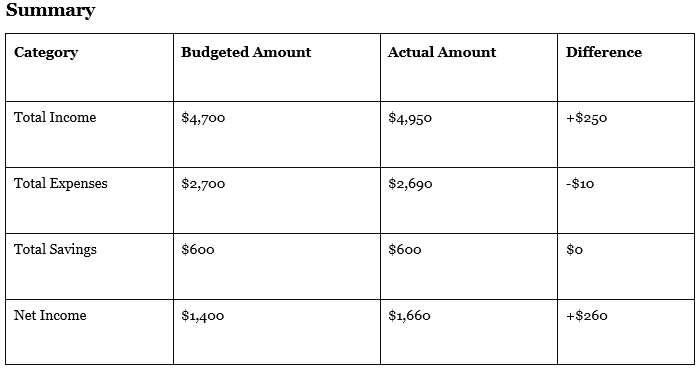

Example Home Budget Template

Here’s an example structure for your budget template:

Tips for Maintaining Your Wealth Rhythm

- Consistency is Key: Stick to your regular review schedule to keep your financial rhythm steady.

- Adaptability: Be flexible and ready to adjust your budget based on changing financial circumstances.

- Focus on Goals: Keep your financial goals at the forefront to stay motivated and disciplined.

By creating a home budget template aligned with Wealth Rhythm principles, you can manage your finances more effectively, ensure consistent savings, and work towards your financial goals with greater ease and confidence.

Tips for Sustainable Budgeting

Achieving financial stability and freedom begins with consistent tracking of your income and expenses. Regular monitoring helps you stay on top of your financial situation, prevents overspending, and ensures you allocate funds to your priorities. Use tools like budgeting apps or spreadsheets to record every income and expenditure. Make it a habit to update your budget weekly to maintain accuracy and keep your financial rhythm steady.

Encourage Regular Analysis of Spending Patterns

Regularly analyzing your spending patterns is crucial for sustainable budgeting. By reviewing your expenses monthly, you can identify trends and pinpoint areas where you may be overspending. This practice allows you to make informed decisions about where to cut back and how to better allocate your resources. It’s not just about tracking but also about understanding your financial habits and making proactive adjustments.

Advocate for Celebrating Progress, Big or Small

Maintaining a sustainable budget can be challenging, so it’s essential to celebrate your progress, no matter how small. Recognizing your achievements, such as sticking to your budget for a month or reaching a savings milestone, can boost your motivation. Celebrating these wins reinforces positive financial behavior and keeps you inspired to continue managing your finances effectively.

Conclusion

A home budget template is a powerful tool for achieving financial freedom. It provides structure, clarity, and control over your finances, helping you make informed decisions and reach your financial goals. By promoting consistent tracking, encouraging regular analysis, and celebrating progress, you can maintain a sustainable budget that works for you.

Start using a budget template today and take the first step towards financial freedom. To help you get started, download our free “Sustainable Budget Template Starter Kit.” It includes everything you need to begin your budgeting journey.

Here’s a little transparency: Our website contains affiliate links. This means if you click and make a purchase, we may receive a small commission. Don’t worry, there’s no extra cost to you. It’s a simple way you can support our mission to help make people wealthier.