When it comes to growing your wealth, it’s all about focusing on what’s coming in—finding multiple ways to bring in income, whether actively or passively. This concept, often referred to as “Money In,” is key to building financial freedom. But in today’s world, it’s not just about working harder; it’s about working smarter. And nothing exemplifies this better than the use of modern AI stock trading software. In this article, we’ll explore the intersection of income streams, investments, and how AI-powered tools like VIP Indicators can take your financial game to the next level.

Understanding Income Streams: Active vs. Passive

When we talk about “money in,” we first need to understand the two primary ways of generating income: active and passive. Active income is what most of us are familiar with—your salary, wages from freelance work, or any income where you are trading time for money. Passive income, on the other hand, allows you to earn without ongoing effort. Popular passive income sources include dividend stocks, rental properties, and royalties from creative works.

However, one of the fastest-growing ways to generate passive income is through investments in the stock market, particularly by leveraging advanced tools like AI stock trading software. With AI, the need to constantly monitor the market is reduced, allowing you to focus on the bigger picture while the software makes intelligent, data-driven trades on your behalf.

Investing Smart: The Role of AI Stock Trading Software

For those new to the world of investments, getting started can seem daunting. Traditional stock trading requires research, analysis, and a deep understanding of market trends. Fortunately, advancements in AI technology have made it easier than ever for beginners and seasoned investors alike to make informed decisions.

AI stock trading software like VIP Indicators uses machine learning algorithms to analyze vast amounts of financial data in real time, identifying trends and executing trades based on patterns that are difficult for human traders to spot. This creates a significant advantage, enabling investors to optimize their returns without having to spend countless hours tracking market movements.

A study by Stanford University highlights the impact of AI in financial markets, noting that AI-driven models have outperformed human traders in several areas, including speed of execution and risk management. By analyzing thousands of data points per second, AI can quickly adapt to changing market conditions—something a human trader simply can’t do at the same speed. This makes AI tools an essential part of the modern investor’s toolkit.

Why AI Stock Trading Software is a Game Changer for Income Growth

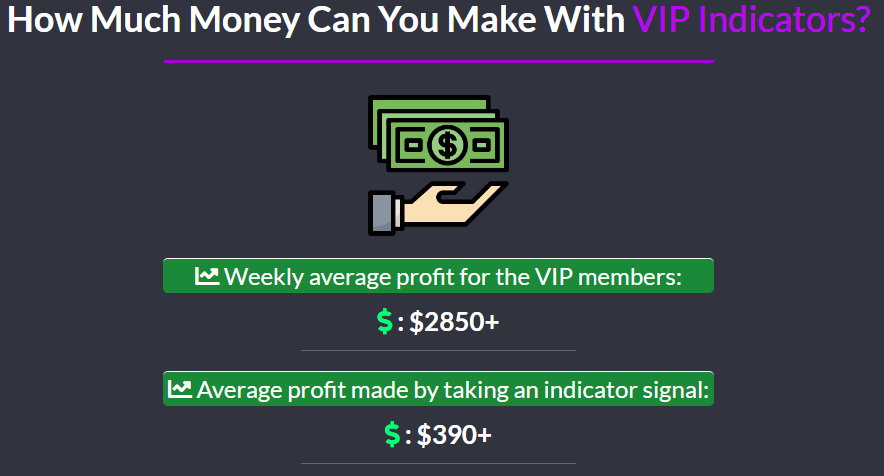

When we talk about “money in” through investments, we have to consider efficiency and scale. The beauty of AI stock trading software is that it allows you to make your money work for you with minimal effort. Unlike traditional trading, where you would have to actively monitor and manually execute trades, AI trading platforms like VIP Indicators automate this process, offering real-time analysis and action.

For those unfamiliar, VIP Indicators is a top-tier AI-driven stock trading software that takes the guesswork out of investing. The software offers:

- Advanced Market Insights: Using complex algorithms, the software predicts market movements with high accuracy.

- Automated Trades: It automatically executes trades based on pre-set strategies, minimizing human error and emotional trading.

- Risk Management Tools: The software includes built-in risk management to protect your portfolio from major losses.

- 24/7 Monitoring: While you sleep, the AI system is working, constantly analyzing global market trends and adjusting strategies accordingly.

But don’t just take our word for it. Harvard Business Review recently published an article emphasizing the increasing reliability of AI-driven trading platforms, citing studies that show their effectiveness in volatile markets. Furthermore, customer reviews on VIP Indicators have been overwhelmingly positive, with one user stating, “I’ve been able to increase my portfolio by 30% in just six months. The AI does all the heavy lifting, allowing me to focus on other projects.”

How AI Stock Trading Software Fits into the Bigger Picture

For investors looking to maximize their “money in,” AI tools like VIP Indicators are revolutionizing the way we think about financial growth. By automating the more tedious and complex aspects of trading, AI software frees up time and reduces the margin for error. This, in turn, allows investors to diversify their income streams—whether through traditional stock investments, crypto, or even alternative markets like commodities.

Another key aspect of growing your money in is scalability. With AI stock trading software, you can manage larger portfolios with greater efficiency. This scalability is crucial for both beginner and advanced investors who want to see exponential growth in their assets. Imagine being able to execute hundreds of trades across multiple markets in seconds—a task impossible for a human but routine for AI-driven platforms.

Putting AI to Work: Your Call to Action

By now, you can see that incorporating AI into your investment strategy is not just a trend, but a necessity for those serious about growing their wealth. Money in isn’t just about working a 9-to-5 job anymore; it’s about leveraging technology to make smarter, faster, and more informed financial decisions.

If you’re ready to take your investments to the next level, it’s time to harness the power of AI with VIP Indicators. This AI stock trading software has been praised by financial experts and users alike for its innovative approach to investing. Whether you’re new to the game or a seasoned investor, this tool can help you grow your portfolio efficiently, while minimizing risk.

Start your journey with AI stock trading software today. Visit VIP Indicators to learn more and unlock your full investment potential.

Here’s a little transparency: Our website contains affiliate links. This means if you click and make a purchase, we may receive a small commission. Don’t worry, there’s no extra cost to you. It’s a simple way you can support our mission to help make people wealthier.

While AI undeniably brings impressive speed and data-driven insights to investing, it’s worth considering the balance between technology and human oversight. AI can process massive amounts of information and spot trends that might be missed by humans, but it still requires well-defined parameters and a strategic vision to guide it. Rather than AI being a necessity for everyone, it’s about integrating it thoughtfully, ensuring that the technology enhances, rather than replaces, human judgement. How do you see AI fitting into your broader financial strategy alongside your own expertise?

AI is a great tool, but human judgment is essential for ethical and strategic decision-making. It’s best used as an assistant, not a replacement.

In my investment strategy, I see AI as a valuable asset for identifying patterns, managing risk, and freeing up time for strategic thinking. However, I’ll always prioritize human expertise for ethical considerations, long-term vision, and adapting to unforeseen market shifts.